Paid media must pay back. These summaries show how disciplined account structure, message-matched pages, and airtight measurement reduce CPA and lift ROAS/MER—across Search, Shopping/PMax, and remarketing.

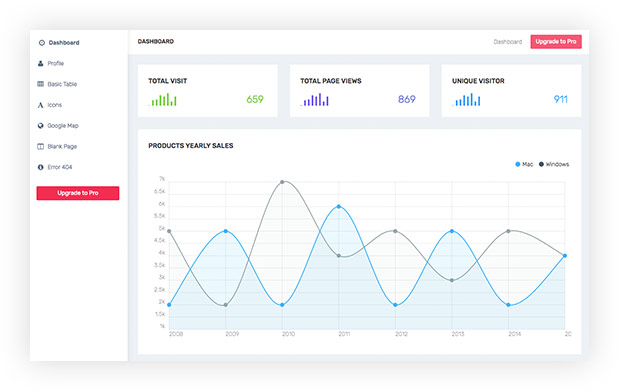

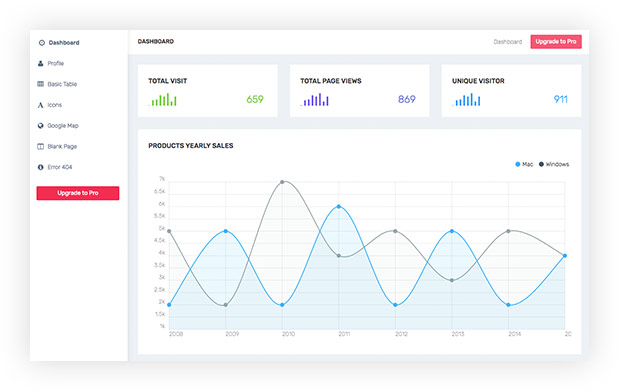

Track how cost-effectively campaigns acquire customers and revenue through CPA, CPL, CAC payback, ROAS, and MER.

Measure traffic strength by analyzing conversion rate, average order value, and impression share across campaigns.

Connect ad performance to real outcomes using offline imports like SQLs, closed sales, and revenue orders.

Identify true paid impact by analyzing assisted conversions and running lift tests where appropriate.

High CPAs, inconsistent match types, and weak landing pages hurting conversions badly.

We rebuilt the search structure using exact and phrase match, tightened negatives, and added call extensions with DNI tracking. We launched fast, phone-first landing pages and connected offline signals for “qualified” and “booked” outcomes. This aligned targeting, intent, and conversion readiness for meaningful CPA reductions.

CPCs rising rapidly while poor product feed eligibility limited profitable scaling.

We upgraded the product feed with GTIN fixes, rewritten titles, and margin-based custom labels. We split PMax for better control, optimized PDP speed, and refreshed creatives. These combined improvements increased eligibility, relevance, and efficiency across Shopping and PMax, lifting ROAS and lowering acquisition costs.

Traffic was strong but demo quality remained weak, producing few sales-ready leads.

We pruned low-quality queries, launched demo-focused landing pages, and synced Lead Gen Form data for cleaner attribution. Offline SQL/Opp imports enabled smarter bidding toward revenue-producing leads. This shifted the entire funnel toward quality—improving demo efficiency, SQL rates, and overall payback from non-brand search.

Low impression share and untracked phone calls limiting visibility and performance clarity.

We created geo-targeted campaigns, applied hour/daypart rules, and strengthened local visibility with location extensions. DNI and call-outcome tagging restored attribution clarity. This combination improved impression share, eliminated waste, and enabled bidding toward truly qualified calls—unlocking stronger acquisition efficiency across multiple locations.

Cart abandonment and outdated creatives weakened remarketing performance and conversions.

We built a remarketing ladder with 1–3d, 4–7d, and 8–30d sequencing, each offering progressively stronger proof and incentives. HTML5 and UGC creative variants boosted engagement, while added PDP FAQs addressed objections. This revived abandoned carts and strengthened returning-user conversion performance.

Competitors bidding on brand terms increased leakage and overall acquisition costs.

We reinforced brand defense with stronger ad extensions, proof-driven assets, and tighter messaging. For non-brand, we deployed exact/phrase structures, layered negatives, and aligned landing pages to intent. These steps cut wasted spend, protected branded visibility, and expanded efficient lead acquisition into new search categories.

We create tightly controlled campaigns using exact/phrase targeting, strong negatives, & PMax guardrails to scale efficiently.

We use message-matched copy and proof-driven assets with frequent refresh cycles to maintain engagement and performance.

We build fast, phone-first landing pages with strong trust elements and clear actions to consistently maximize conversions.

We implement GA4, GTM, server-side tracking, and offline imports to measure true SQL, sales, and revenue impact.

We maintain brand safety with structured change logs, pacing controls, and alert systems ensuring consistent, predictable performance.

Email to request full PPC case PDFs and a 90-day plan tailored to your niche.

Chat with Us on WhatsApp